Too Big To Fail

Shocking corporate meltdowns never cease to amaze us. There are always vicissitudes in the market, and these routinely capsize smaller boats. But big ships aren’t supposed to sink -- just ask the passengers of the Titanic.

When major companies go bust, thousands of employees lose their livelihoods, and investors lose their shirts. In the worst instances, we all lose a little bit of our confidence in the honesty and decency of our fellow humans.

Let’s take a look at 10 of the most spectacular corporate meltdowns in history -- caused by everything from fraud to incompetence to court rulings.

Francis Godolphin Osbourne Stuart on Wikimedia

Francis Godolphin Osbourne Stuart on Wikimedia

10. Adelphia

Adelphia was a communications company founded way back in 1952. It went on to become the fifth-largest cable provider in the United States. Unfortunately, corrupt ownership led to the company’s sudden collapse in 2002.

It turned out the owner and his son had engaged in complicated transactions to hide the fact they had stolen about $100 million from the company. During the bankruptcy proceedings, it also came to light that Adelphia had more than $2 billion in hidden debt.

Chrisjnelson at English Wikipedia on Wikimedia

Chrisjnelson at English Wikipedia on Wikimedia

9. Polly Peck

You may not have heard of Polly Peck. It was a small textiles company based in the UK that had a meteoric rise in the 1980s. Unfortunately, it also crashed and burned like a meteorite.

It collapsed in 1991, floundering under £1.3 of debt. Its CEO, Asil Nadir, then fled the UK to hide out in Cyprus. He later returned to England and was convicted of misappropriating £29 million.

8. Thomas Cook

Thomas Cook was one of the world’s oldest travel companies; it was 178 years old when it went broke in 2019. Investors had been shorting it throughout the year as the company had been struggling to restructure itself via closures and layoffs.

When the end came, it left more than 600,000 travelers stranded. One guy even reported that his resort was holding him hostage until he paid the money Thomas Cook owed them.

7. Pan American World Airways

It’s hard to believe, but Pan Am used to be America’s biggest airline. It was the unofficial flag carrier for the United States. But none of these distinctions protected it from going belly up in 1991.

The first sign of real trouble was the Lockerbie bombing of 1988. In that incident, a terrorist bomb destroyed a Pan Am flight over Scotland. It partly destroyed Pan Am’s brand as well.

The second crisis came with the 1991 Gulf War. The conflict drove up the price of oil drastically, making Pan Am’s transatlantic routes unprofitable. It ended up selling these off and filing for bankruptcy protection.

6. Standard Oil

Standard Oil was once the… well, standard of American enterprise. It was founded by John D. Rockefeller in 1870, and grew to be the largest energy company in the world. It’s widely credited as one of the first truly modern multinational corporations.

Unfortunately, it was also a monopoly. That’s what the Supreme Court ruled in 1911, subsequently breaking Standard Oil up into 34 smaller companies.

However, this actually benefited Rockefeller immensely. He remained the biggest shareholder of all these new companies, which collectively made him the richest man in history up to that time -- and arguably ever, relative to the US GDP at the time.

Unbekannte Autoren und Grafiker; Scan vom EDHAC e.V. on Wikimedia

Unbekannte Autoren und Grafiker; Scan vom EDHAC e.V. on Wikimedia

5. Allied Crude Vegetable Oil Refining Corp

Most of the collapsed businesses we’ve discussed so far at least did what they said they were doing, and tried to do it honestly. Not so with Allied Crude.

This ‘company’ was founded by commodities trader Tino De Angelis. In the 1960s, De Angelis convinced his backers he had acquired a large and lucrative stockpile of vegetable oil. He used this commodity to secure loans and make a huge profit.

However, it turned out he didn’t have any vegetable oil at all. He had filled drums with water and put a small amount of oil on top. In the course of his scheme, he took 51 major banks for the equivalent of $1.5 billion.

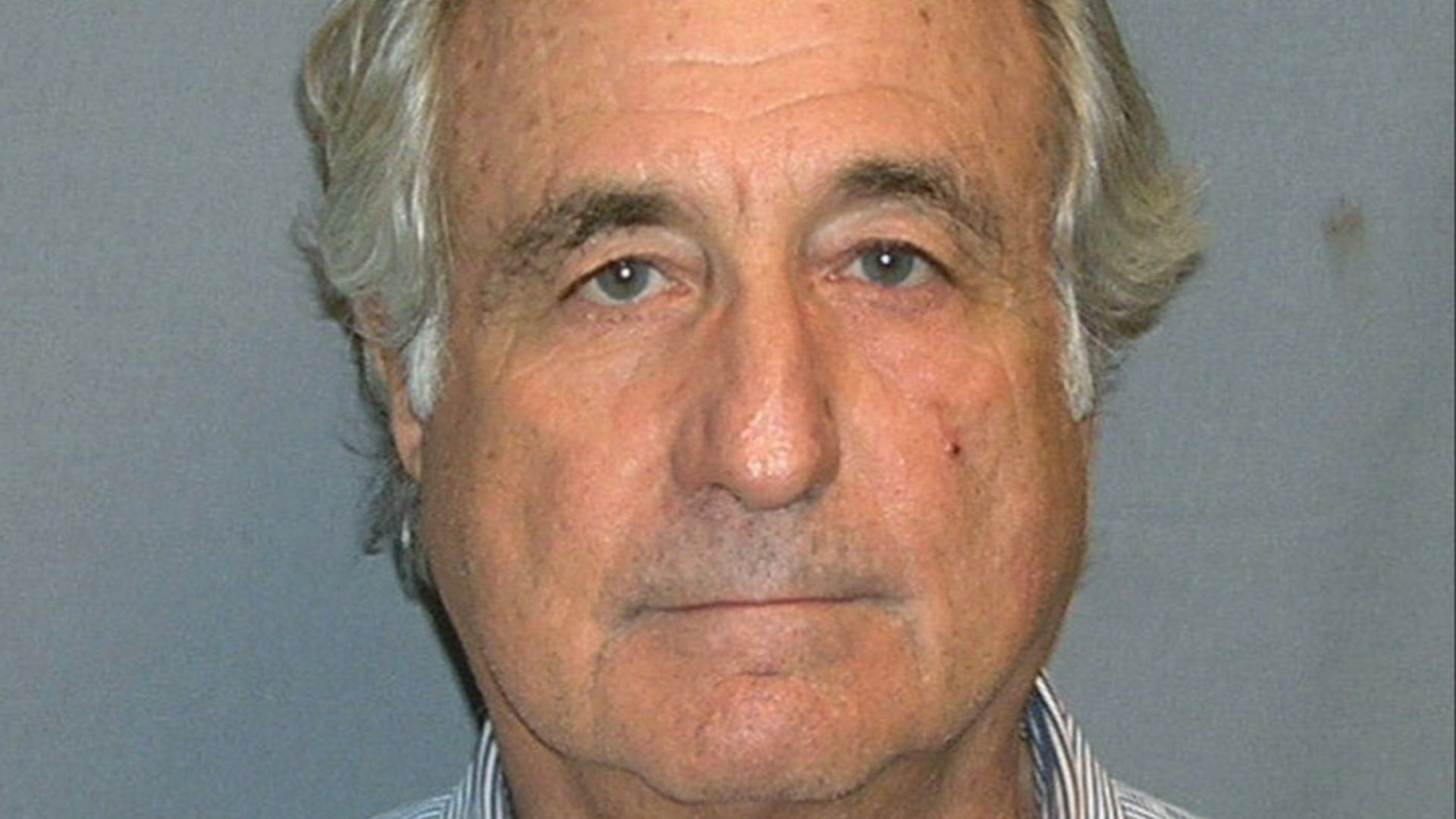

4. Bernie Madoff

Bernie Madoff’s name has become synonymous with white collar crime. He perpetrated the largest Ponzi scheme in history through his company, Bernard L. Madoff Investment Securities LLC.

Investors were stunned at the returns they got investing with Madoff -- consistently better than you could find anywhere else. Madoff made his scam seem more appealing and legitimate by being choosy with his investors; only the very best were good enough to deal with him.

But, of course, it was all a lie. Madoff was paying returns to his backers with money he received from other investors. He was arrested the day after he told his sons what he was doing.

In all, Madoff defrauded $64.8 billion. Easily one of the most shocking corporate meltdowns.

U.S. Department of Justice on Wikimedia

U.S. Department of Justice on Wikimedia

3. Lehman Brothers

The collapse of Lehman Brothers was the first falling domino that triggered the Great Recession of 2008.

Lehman had been deeply implicated in shady mortgage investments since 2003. On the back of deregulation, they bought into the market big time, effectively gambling their entire company on securities that were not secure.

When the subprime mortgages hit the fan, Lehman collapsed. Its remaining parts were bought up for pennies on the dollar.

2. Enron

The collapse of Enron still continues to reverberate to this day. It was one of America’s largest and most respected corporations. Fortune ranked it the most innovative company for six years running, and it reported more than $100 billion in revenues in 2000. Yet somehow, it was bankrupt by the end of 2001.

The horrible truth was that Enron was one giant fraud. Its CEO, Jeffrey Skilling, implemented mark-to-market accounting, allowing Enron to book profits on projects that hadn’t even been completed yet. The problem was that many of these projects were total failures that never made a dime. But Enron invested the “profits” it made on these plays into other losing ventures.

The company tried desperately to cook its books and keep the stock price up, but Enron was ultimately exposed for what it was: a house of cards.

1. Arthur Andersen

Enron’s meltdown was so epic that it took another big company with it: Arthur Andersen.

Arthur Andersen was one of the world’s biggest accounting firms, its name a byword for integrity. However, the collapse of Enron exposed Arthur Andersen, which had served as accountant to the disgraced energy conglomerate.

The accounting firm was meant to have audited Enron’s books, but somehow completely missed $100 billion in fraudulent reported revenues. Andersen’s reputation was further tainted by the revelation that it shredded thousands of documents relating to its Enron account.

Arthur Andersen was forced to surrender its CPA licenses in 2002.